Introduction

Gold has long been a symbol of wealth, security, and a store of value in India. Whether it’s for personal adornment or investment purposes, gold has an enduring legacy in the country. Among the different forms of gold available, 100-gram gold biscuits have become a preferred choice for investors looking to buy gold in its purest form. In India, gold is often seen as a hedge against inflation and a secure way to preserve wealth over time.

The price of a 100-gram gold biscuit in India is influenced by several factors, including international gold prices, local demand and supply dynamics, and government policies. In this comprehensive guide, we will explore the price of 100-gram gold biscuits in India, the factors that affect their cost, the best practices for buying and investing in gold, and alternatives to physical gold investment.

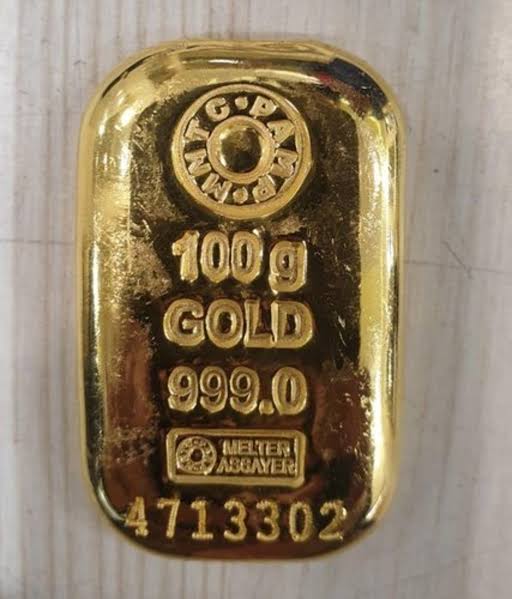

What is a 100 Gram Gold Biscuit?

A 100-gram gold biscuit is a rectangular-shaped bar of gold, weighing exactly 100 grams. These biscuits are usually made from 24 Karat gold, which means they are 99.99% pure, making them an excellent option for investors who want to purchase gold with minimal impurities. Gold biscuits are also known for their simplicity, with most of them being plain and free from intricate designs, unlike gold coins or jewelry.

Gold biscuits are typically sold based on their weight and purity, and they are often favored by investors due to their ease of storage and transport. They do not come with additional making charges, which are commonly associated with gold jewelry. This makes them an ideal choice for individuals who wish to invest in gold as a commodity, rather than as an accessory.

One of the significant advantages of purchasing gold biscuits is the fact that they are considered more secure and less likely to lose value over time, thanks to their high purity and relatively standardized price based on weight and gold content.

How the Price of 100 Gram Gold Biscuits is Determined

Understanding how the price of a 100-gram gold biscuit is determined is essential for anyone looking to invest in gold. The cost of these gold biscuits depends on various global and domestic factors, which fluctuate regularly.

1. Global Gold Prices

The most significant factor in determining the price of gold biscuits in India is the international gold price. Gold is traded on global markets, and its price is usually quoted in U.S. dollars per ounce. The gold price is highly sensitive to global economic factors, including geopolitical events, inflation rates, and changes in global demand. When there is uncertainty in financial markets or economies, investors tend to flock to gold as a safe-haven investment, driving up the price.

The international gold price affects India’s domestic gold prices due to the country’s dependence on imported gold. India is one of the largest consumers of gold in the world, with the majority of its supply coming from abroad. Consequently, any fluctuation in global gold prices has a direct impact on the cost of 100-gram gold biscuits in India.

2. Currency Exchange Rates

Gold is priced in U.S. dollars, so the exchange rate between the Indian Rupee (INR) and the U.S. Dollar also plays a crucial role in determining the price of gold in India. When the Indian Rupee weakens against the U.S. Dollar, the price of gold tends to rise, as it becomes more expensive to import gold. Conversely, when the rupee strengthens, the cost of gold may decrease.

Since the currency exchange rate is constantly changing, this is one of the key factors that impact the price of 100-gram gold biscuits in India. For investors looking to buy gold, paying attention to currency movements is essential, as even small fluctuations in the INR-USD exchange rate can significantly affect the cost of purchasing gold.

3. Local Taxes and Import Duties

In addition to the global price of gold, the Indian government imposes certain taxes and duties on gold imports, which directly affect the final cost of gold biscuits. The Goods and Services Tax (GST) on gold in India is set at 3%, which is added to the cost of the gold at the time of purchase. Additionally, the government imposes customs duties on gold imports, which can vary depending on the prevailing economic conditions and government policies.

Changes in import duties or taxes can cause the price of 100-gram gold biscuits to increase or decrease. For instance, if the government raises import duties, the price of gold may rise, as importers will pass on the additional cost to consumers. As a result, keeping an eye on any changes to tax policies is important for anyone looking to invest in gold.

4. Domestic Demand and Supply

In India, demand for gold is influenced by several factors, including cultural practices, festivals, and wedding seasons. Gold has immense cultural and religious significance in the country, especially during weddings and festivals like Diwali and Dussehra. During these times, the demand for gold increases, which can lead to higher prices.

Additionally, local supply constraints can also impact the price of gold. India imports nearly all of its gold, and any disruptions in global gold supply chains, such as mining issues or trade restrictions, can cause supply shortages and drive prices up. Similarly, any shifts in consumer preferences or changes in the economic environment can alter the domestic demand for gold, further impacting prices.

Historical Price Trends of Gold in India

The price of gold has witnessed significant fluctuations in India over the years. Historically, gold prices have tended to rise over time, although there have been periods of decline. Understanding these trends can help investors make informed decisions when buying 100-gram gold biscuits.

1. The 2013 Gold Price Spike

In 2013, gold prices in India surged to record highs, driven by a combination of factors, including global economic uncertainty, the weakening of the Indian Rupee, and rising inflation. At the time, investors sought refuge in gold as a safe-haven asset, pushing up prices. The surge in demand, combined with the higher costs of importing gold, resulted in gold prices reaching historic levels.

2. The Covid-19 Pandemic and Gold’s Rise

The onset of the Covid-19 pandemic in 2020 created significant uncertainty in global financial markets. Stock markets plummeted, and investors flocked to gold as a safe asset, which led to a sharp increase in gold prices. In India, the price of gold hit new highs during this period, as the pandemic-driven economic crisis drove demand for gold to unprecedented levels.

Despite some volatility, the pandemic reinforced gold’s reputation as a hedge against financial uncertainty. As the global economy began recovering in 2021, gold prices remained elevated, and India saw continued interest in gold as a long-term investment.

Current Price of 100 Gram Gold Biscuit in India (2025)

As of 2025, the price of a 100-gram gold biscuit in India ranges between INR 5,50,000 and INR 6,00,000. However, gold prices are highly volatile and change regularly based on global and domestic factors. In some cases, prices can even vary within a single day. Therefore, it is essential to monitor the market trends and buy when the price is favorable.

Additionally, prices may vary depending on the brand, dealer, and region. In major metropolitan cities like Delhi, Mumbai, and Chennai, prices may be slightly higher due to transportation costs and premium charges by dealers.

Factors Influencing Gold Prices in India

1. Geopolitical Events and Global Crises

Geopolitical tensions, such as wars, political instability, and trade disputes, can lead to an increase in gold prices. Gold is often seen as a safe-haven asset, and when investors perceive a threat to financial stability, they tend to buy gold in large quantities. This surge in demand can drive prices higher.

2. Economic Indicators and Inflation

Gold prices are often inversely related to economic indicators like interest rates, inflation, and stock market performance. When interest rates are low, and inflation is high, gold tends to become more attractive as an investment. This is because gold provides a hedge against inflation and does not yield interest, unlike bonds or savings accounts.

3. Seasonal Demand

In India, gold prices tend to rise during the wedding season and major festivals. This seasonal demand can push up prices, especially in the months leading up to Diwali, Akshay Tritiya, and wedding season (November to February). During these times, gold is considered an auspicious purchase, and demand often outstrips supply.

How to Buy a 100-Gram Gold Biscuit in India

1. Reputed Dealers and Retailers

To ensure that you are buying genuine 100-gram gold biscuits, it is crucial to purchase from reputable dealers. Leading jewelry stores, banks, and financial institutions offer 100-gram gold biscuits. Some of the most trusted names in India include Tanishq, Malabar Gold & Diamonds, and Kalyan Jewellers.

2. Online Platforms

In recent years, buying gold online has become increasingly popular. Several online platforms, including Amazon, CaratLane, and others, offer 100-gram gold biscuits. However, when buying gold online, it is essential to ensure that the website is reputable and offers certification for the gold’s purity.

3. Certification and Authenticity

When purchasing a 100-gram gold biscuit, always ask for a certificate of authenticity. This certificate guarantees the purity and weight of the gold, ensuring that you are getting the value you are paying for. Look for biscuits certified by well-known refiners, such as MMTC-PAMP, which is a trusted name in India.

Investment in 100-Gram Gold Biscuits: Advantages and Risks

1. Long-Term Investment

Gold is considered a long-term investment, especially for those looking to preserve wealth over time. Historically, gold has maintained its value and acted as a hedge against inflation and currency devaluation. It is an asset that tends to perform well during periods of economic or financial uncertainty.

2. Risks and Considerations

While gold is generally a safe investment, it is not immune to risks. Gold prices can fluctuate, and there is a possibility of short-term losses, especially during times of market volatility. Additionally, storage and insurance costs can eat into your returns if you are holding a large amount of physical gold.

3. Liquidity

One of the advantages of investing in gold biscuits is their liquidity. Gold is universally recognized, and you can easily sell your 100-gram gold biscuit at any time. However, the price you receive will depend on the current market rate.

Taxation on Gold in India

Investors in gold biscuits need to be aware of the tax implications of buying, selling, and holding gold.

GST: Gold in India is subject to a 3% Goods and Services Tax (GST) at the time of purchase. This tax is added to the cost of the gold when buying from a dealer.

Capital Gains Tax: If you sell your 100-gram gold biscuit at a profit, you may be subject to capital gains tax. If the gold is sold within three years of purchase, it is subject to short-term capital gains tax (STCG) at a rate of 20%. If held for more than three years, long-term capital gains tax (LTCG) applies at 3%.

Alternatives to 100-Gram Gold Biscuits for Investment

While 100-gram gold biscuits are an excellent investment choice, there are other ways to invest in gold.

1. Gold ETFs

Gold Exchange-Traded Funds (ETFs) allow investors to buy gold in paper form without physically holding the metal. Gold ETFs track the price of gold, and investors can buy or sell shares in the ETF on stock exchanges.

2. Digital Gold

Digital gold platforms allow investors to buy small amounts of gold and hold it in a digital format. The gold is stored in a secure vault on the investor’s behalf, and the gold can be redeemed or sold at any time.

3. Gold Mutual Funds

Gold mutual funds invest in companies related to gold, including mining companies. They provide indirect exposure to the price of gold and offer diversification for investors looking to add gold exposure to their portfolio.